Every day, more and more businesses do the right thing by integrating an enriched amount of web accessibility practices into their digital activities.

Whether it may be native accessibility techniques, automated tools, or other accessibility services, these businesses take advantage of solutions that allow them to open their websites to everyone and achieve ADA compliance simultaneously.

However, while affordable solutions do exist for businesses of any size, accessibility fees that are invested into both offline and online spheres can still surprisingly add up by the end of the year.

For this reason, the U.S. government has chosen to promote and support those accessibility practices that comply with the Americans with Disabilities Act (ADA) by incentivizing the efforts made and sustained with a tax credit (a credit is the amount subtracted from your overall liability after you calculate your taxes).

What is the ADA Tax Credit?

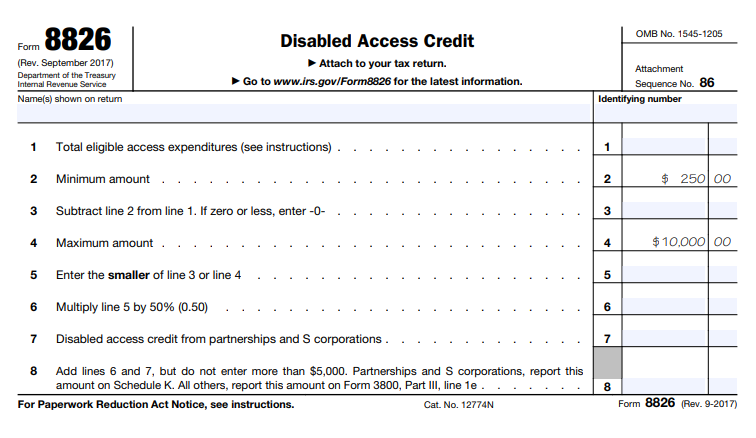

The tax credit, listed under Section 44 of the IRS Code, covers 50% of the eligible access expenditures made during the previous tax year, with a maximum expenditure limit of $10,250. There is no credit for the first $250 of the expenditures, and so, it is subtracted accordingly. Therefore, the highest amount of credit a business can receive is $5,000.

For example, let’s say a business spends $1,490 on accessWidget (and that’s its annual accessibility fee). We would subtract $250 from that, which leaves $1240. The business is then receiving 50% of what’s left, which equals $620 in credit.

Are you eligible for the ADA Tax Credit?

The ADA tax credit benefit is available to businesses that generated $1,000,000 or less during the year prior to filing or businesses that employ 30 or fewer full-time employees.

Where do accessible websites stand with the ADA Tax Credit?

The ADA was initially drawn up with the intention of applying its rules and regulations to the evolving internet landscape. Currently, the ADA covers websites and does in fact mandate accessibility in the digital arena; this means that the tax credit very much applies to businesses who invest in owning and operating accessible sites.

Many accessibility practices or types of implementation are included in the list of qualifying expenditures, but there is also a variety of accessibility elements to look at when calculating your annual accessibility fee. These include homepage adjustments, page structure and hierarchy, live chat support that makes a site more accessible, and messaging (copy and content).

Paid-for services such as file and media remediation also qualify as an expenditure.

What stipulations do you need to be aware of?

The great news is that the ADA tax credit can be applied for and earned on an annual basis!

Although, expenditures may not be carried over from the previous year to claim a credit that exceeded the expenditure limit from the year before. But, if the credit amount you’re entitled to exceeds the amount of taxes that you owe, you are allowed to roll the unused portion of the credit forward into the next year.

The tax credit covers the following accessibility and ADA-related expenditures:

- web accessibility solutions or tools that optimize websites

- the hiring of sign language interpreters

- the purchase of adaptive equipment

- the production of accessible formatting on printed materials (braille, large print, audiotape, computer diskette)

- the removal of architectural barriers in facilities or vehicles

- fees for consulting services

Here’s how to apply for the ADA Tax Credit…

Let’s dive into the application process so you can ensure that you dot your i’s and cross your t’s. First things first, please refer to the Tax Incentives for Improving Accessibility Fact Sheet which provides facts on the tax credit.

Once you have confirmed that your business is eligible, fill out Form 8826 to apply. It must then be attached to your yearly tax return and sent alongside it. You’re able to find Form 8826 on the IRS government website, where you can also research the rules and stipulations regarding the tax credit itself. More instructions can also be found on page 2 of Form 8826.

You can also read more on the IRS Tax Credits and Deductions page on ada.gov.

Before you sign off and send in your comprehensive return files, don’t forget to consult with a CPA or tax professional. If a CPA firm doesn’t know this credit exists, make sure to tell them the form number (8826).

They can easily fill out the form and state the accurate amount spent on accessibility efforts, speeding up the process and ensuring it’s done right!

Frequently asked questions about ADA tax credits

Q1. What is the ADA tax credit?

A1. The ADA tax credit is a federal incentive under U.S. tax law that allows eligible small businesses to claim a credit for costs incurred while making their facilities, websites, or digital assets accessible to people with disabilities.

Q2. Who is eligible for the ADA tax credit?

A2. Businesses qualify if they had gross receipts of $1 million or less in the preceding year, or employed 30 or fewer full-time employees. The credit is available to those incurring accessibility-related expenses.

Q3. How is the credit calculated?

A3. First, subtract the initial $250 of access-related expenses from the total. Then the credit covers 50% of the remaining amount, up to a maximum expenditure cap of $10,250—meaning the highest possible credit is $5,000.

Q4. What types of expenses may qualify?

A4. Qualifying expenditures include website accessibility updates (alt text, keyboard navigation, structural fixes), assistive-technology purchases, accessible format production, and consulting services aimed at removing barriers for users with disabilities.

Q5. Does the credit apply to digital accessibility improvements like websites?

A5. Yes. Improvements to websites and digital services that address accessibility barriers may qualify, provided the business meets the eligibility criteria and the expenditures fall under “reasonable and necessary” costs for accessibility.

Q6. Can this tax credit be combined with other deductions or credits?

A6. Yes. For example, the ADA credit under Section 44 and the architectural barrier removal deduction under Section 190 can be claimed in the same year—though the same dollar cannot be counted twice for both incentives.

Q7. When and how do you claim the ADA tax credit?

A7. Businesses claim the credit by completing IRS Form 8826 (Disabled Access Credit) and including it with their tax return. Thorough documentation of eligible expenses and their accessibility purpose is essential.

Q8. How can accessiBe support businesses claiming the ADA tax credit?

A8. accessiBe helps businesses qualify and optimize the credit by providing audit services, accessibility solutions, and documentation support. Their tools and methods help identify eligible expenses and document accessibility efforts that align with the tax credit’s requirements.